1.1.3 Key highlights

Stable, sustainable growth

In 2017, we strengthened our position as Russia’s leading food retailer, expanding our truly multi-format business model and accelerating our pace of growth, while continuously innovating to improve efficiency and enhance our customer value proposition.

We strengthened our lead as Russia’s #1 food retailer. We extended our lead over the other largest players in 2017, as we maintained our focus on sustainable and high-quality growth, and by consistently providing customers with a high-quality value proposition in every one of our stores in Russia.

Our rapid expansion continued in 2017, and we ended the year with a total of 12,121 stores, having added 2,934 stores throughout the year. With a consistent focus on innovation, efficiency and quality, we aim to deliver on our strategic targets of sustainable and rapid growth of our multi-format food retail business, creating value for our customers to the benefit of all of our stakeholders.

2017 operating and financial highlights

Strategic highlights

Russia’s #1 food retailer expanding our lead in terms of market share: 25.3% year-on-year revenue growth, faster than the top 10 players, and the sector as a whole.

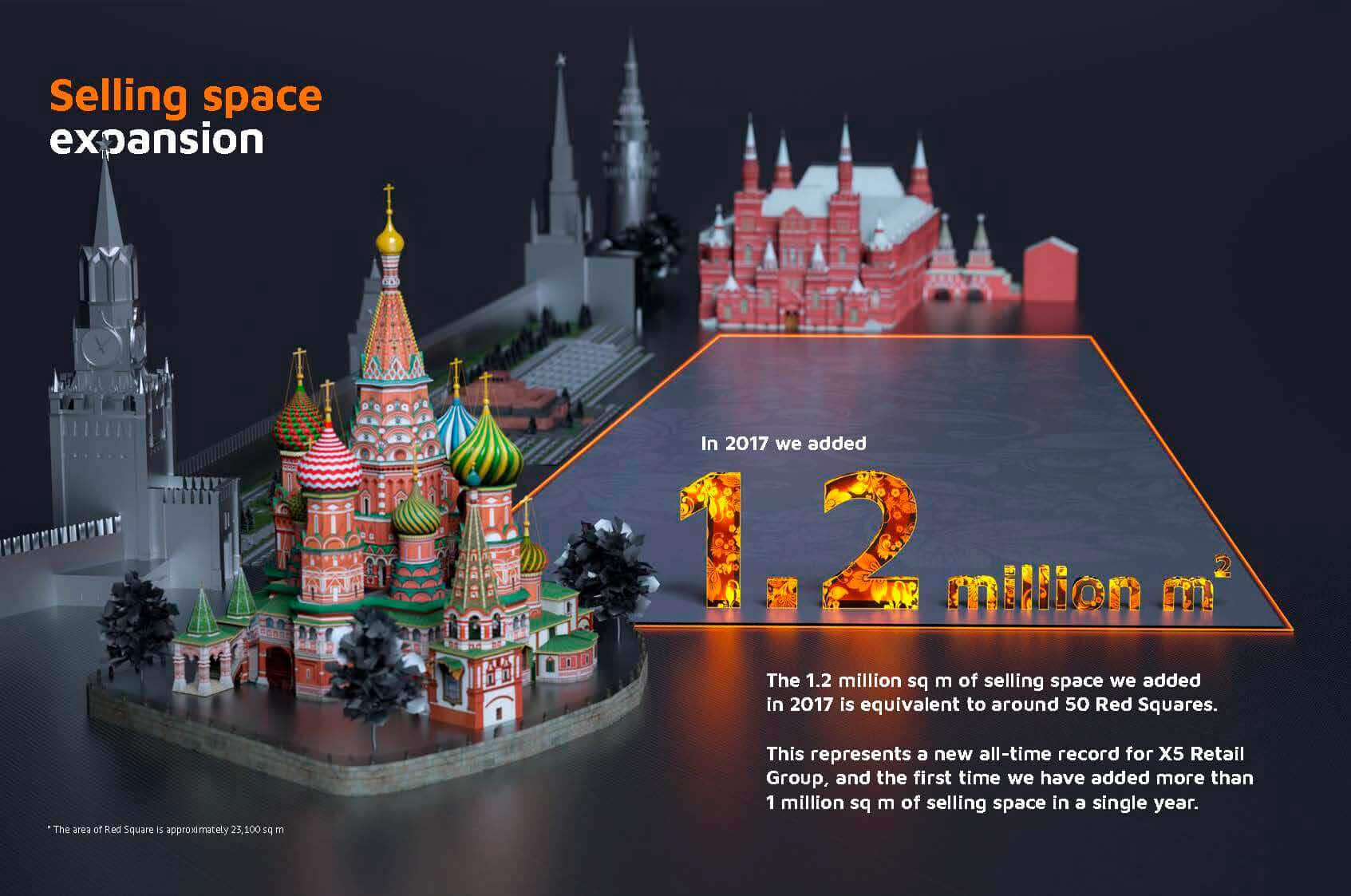

Rapid expansion: 2,934 new stores added; 1.2 million sq m of new selling space added, expanding our regional presence and increasing the diversity of customers served across Russia.

Refurbishments and day-to-day improvements: almost all Pyaterochka stores and more than 73% of Perekrestok stores are now operating under their new concepts as of 31 December 2017. Elements of our new concept and operating model for Karusel are being trialled in a new store.

Preparing for the future of food retail: we are developing innovative projects using big data analytics for personalised offers and measurement of targeted marketing campaigns. This will enable us to increase customer activity by better addressing consumer demand in the future.

Developing omni-channel business model: we have successfully launched Perekrestok Online in Moscow, which complements our offline offering, but with an average basket several times higher than brick-and-mortar stores, an exceptionally high 73% NPS score, and strong customer loyalty.

Constant focus on operational efficiency and cost optimisation in every line: adjusted SG&A (see APMs information in section Information on alternative performance measures) declined to 16.8% of revenue, the lowest since 2010, as well as successful efforts to improve supplier terms, close down inefficient logistics operations, and automate manually intensive high-volume and routine tasks.

Enhanced logistics: 10 new distribution centres across Russia and an additional 1,231 new trucks, bringing our total fleet to 3,144 as of 31 December 2017.

Approved dividend policy: the Supervisory Board approved a dividend policy for the Company, with a target payout ratio of at least 25% of X5 Retail Group’s consolidated IFRS net profit in case of a consolidated net debt/EBITDA ratio of below 2.0x. Based on the Company’s 2017 financial results, the Company’s Supervisory Board has put forward a recommendation to pay dividends in the amount of RUB 21,590 million / RUB 79.5 per GDR, subject to related fees and taxes.

Operational highlights

Our omni-channel and personalised approach enabled us to continue to improve customer experience both in-store and online, while boosting operational efficiency supported by smart logistics and big data.

Financial highlights

X5’s strategy calls for growth faster than the market and competition while at least maintaining margins.

Sustainability highlights

We measure our performance by more than just operational and financial metrics. In this report, we discuss in greater detail our integrated approach to building a sustainable business.