hypermarkets

Last year marked a turning point for Karusel, as we developed and approved a new customer value proposition and branding for our hypermarkets, which are based on a deep understanding of our target audience and modern shopping trends. Our approach is to offer customers a modern and convenient shopping experience, including in-store entertainment, such as our own restaurants, coffee shops and pizzerias, as well as an assortment that covers the needs of an entire family and facilitates stocking up for a longer period of 1-2 weeks. Our price and promo proposition, supported by a modern loyalty programme, is aimed at generating value for our customers and building long-term relationships with them. Our services are upgraded in order to create hassle-free, time-efficient shopping, hence allowing our customers to spend more quality time with their families.

This approach has been developed through extensive pilot testing, and we are confident that the new Karusel hypermarkets will create significant value for our customers and contribute to the future growth of X5 Retail Group.

Karusel is one of the largest hypermarket formats in Russia, offering customers a modern and convenient shopping experience with a wide choice of food products and a smart selection of non-food product “worlds”. With families as our key target audience, we aim to provide solutions for family budgets. In 2017, we launched a pilot hypermarket based on Karusel's new branding and operating model, and we plan to expand this new model across the format in the coming years.

Karusel stores offer an assortment of 22,000 to 30,000 PLUs of food and non-food items, with an average selling space of 4,143 square metres.

Performance highlights

sales

in operation

space

visits

refurbished

Strategic highlights

| 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|

| Number of stores, eop | 83 | 82 | 90 | 91 | 93 |

| Selling space, ’000 m2 eop | 376 | 359 | 390 | 387 | 385 |

| Net retail sales, RUB bln | 64 | 69 | 77 | 84 | 89 |

| Customer visits, mln | 122 | 123 | 129 | 134 | 135 |

Strategic priorities for 2017

| Our priorities | What we did | What we plan to do |

|---|---|---|

| Adapt CVP to target customer base |

|

|

| Launch new CVP and rebranding |

| |

| Develop programmes to enhance customer loyalty |

| |

| Adopt omni-channel model |

|

New CVP launched

In 2017, we approved our new CVP and introduced elements of this in-store in St Petersburg. The updated proposition is aimed at families with a rational approach to shopping who are looking to buy goods for 1-3 weeks in advance. Our new store layouts are intended to provide customers with easy navigation, access to a full range of products for the whole family, and offer a convenient in-store experience with cafes and restaurants on premises that are equipped with shopping cart “parking spaces” next to tables.

Under the new CVP, we aim to open 4,000-5,000-square-metre hypermarkets in prime locations. The assortment in new hypermarkets will be slightly smaller than before, with 20,000 to 22,000 PLUs, with an increased focus on first-price and mid-price goods. We aim for Karusel to be perceived as a price leader in key traffic categories and to encourage customers to stock up with larger volumes of basic goods.

Customers have responded well to the new elements that have already been introduced, and the pilot hypermarket in St Petersburg has achieved better NPS scores, as well as higher sales in several key categories.

- Arranging store zones according to customer logic

- Easily readable navigation

- Redistribution of shelf space according to category roles

- Emotional design in non-food product categories and leaders

- Creating product worlds (in leader categories)

- Communication focus on prices and creating customer value. Minimum noise

- Using the design to emphasise the scale of the store

Rebranding

Our key goals were to retain Karusel's current loyal audience and brand awareness, while also showing that the brand is changing for the better in order to attract new customers.

The new Karusel brand launched in 2017 is aimed at communicating the updated CVP, with a focus on stability, order and structure. The new branding, aimed at rational buyers, is meant to be associated with favourable pricing, honesty and transparency in our offer to customers.

In order to communicate the changes in Karusel's CVP and improve the perception by the target audience, we decided to change the brand identity.

Updating our assortment

Under the updated CVP, the Karusel assortment will focus on leader categories and on encouraging customers to buy larger volumes of goods in a single shopping trip. By optimising the assortment and increasing the share of basic and leader categories, we believe that we will be able to better meet our customers' shopping needs.

We will also increase our assortment in fresh categories, while the selection of non-food goods will also contract, with a focus on creating “category worlds” such as “home”, “childhood” and “seasonal offers”.

| Current brands | New brands | |

| High |

| |

| Medium |

|

|

| First price |

| |

| Niche |

|

|

Private labels

Private labels are an efficient way to diversify our assortment and price offerings. The share of private-label goods in net retail sales increased to 3.5% in Q4 2017 from 3.2% in Q4 2016. As of the end of 2017, our hypermarkets had over 800 “Year-Round” (“Krugli God”) private-label PLUs and more than 120 other private-label SKUs. By the end of 2020, we are aiming for private label goods to account for 6-8% of net retail sales.

Our new private label, “Smart solution” (“Umnoe Reshenie”), is being developed in line with the updated CVP, which targets rational shoppers buying goods for the whole family.

Umnoe Reshenie

Own production

Karusel's in-store production is a key part of our updated CVP, and we continued to develop this part of the business in 2017. The share of Karusel's own production in net retail sales increased from 13.7% in 2016 to 14.1% in 2017. We aim to increase the share of our own production in the future across a range of products from delicatessen and ready-to-eat to fresh meat and poultry, fish and seafood, bakery and cheeses.

Loyalty programme

Karusel’s loyalty programme, which was relaunched in 2015, continues to develop in line with our Group-wide push to leverage data analytics to improve performance. Karusel’s loyalty card holders have started receiving personalised offerings and promotions based on their preferences and shopping behaviour. We have also launched the “My Karusel” mobile app for loyalty programme members.

The Karusel loyalty programme accounted for 68% of net retail sales on average in 2017, with almost 80% at the end of the year, increasing from 46% in 2016. The long-term goal is to reach 90-95% by the end of 2020.

Online sales

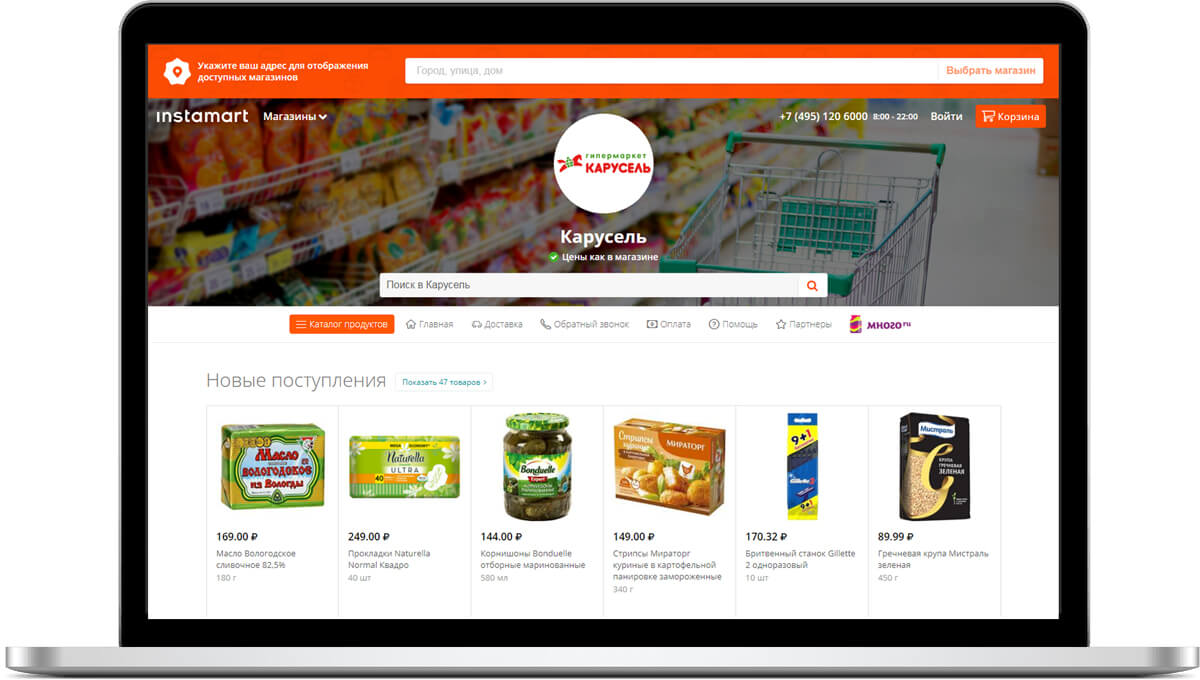

Omni-channel sales are a key to the future development of Karusel, and we launched a partnership with Instamart in late 2017 to give customers the option to order goods from Karusel online and have them delivered by Instamart.

At present, this partnership covers Moscow and includes 8,500 SKUs that are available online. In the future, we are considering expanding this offering to St Petersburg.